How to Generate Passive Income in Retirement

One is retired, but independence is not; thus, there is a need to continue being financially secure. It is helpful to build passive income sources to make your future safe without simply depending on savings or pensions. Here is how one could quickly generate some forms of passive income during retirement;

Invest in Dividend-Paying Stocks

Stock investments are also one of the most preferred means through which people can earn passive income to support their retired lives. Some of these stocks give a fraction of the company's profits to investors, so the investors receive a steady income. One of the benefits is in the stock selection when investing in companies with a long history of paying dividends is more profitable. One has to ensure that he invests in many areas as one wants to avoid ending up in a situation where they have invested all their Money in one area because changes in this area and the variables within will affect the amount of Money one earns.

Rental Properties for Consistent Cash Flow

Of course, investing in real estate has always been a good investment. Real estate investment is a reliable way to get passive income, as owning rental houses or apartments will give regular income. After you buy property, lease revenues will help pay most of the costs and bring in net income. Minimizing interaction means hiring a property management company to handle other issues with the tenants and the property. Business in real estate can also grow over time, and additional income would be a bonus.

Create and Sell Digital Products

Of course, passive income is not new, but the digital age has created new ways to achieve it. Any professional with sector or industry knowledge can set up a home-based business to develop digital products such as eBooks, courses, or software applications for sale. After acquiring these products, income may be created without reinvestment in the product or service. You can make your products available through channels such as Amazon or Udemy or by using an Etsy store, and then your things could sell on their own as you take your well-earned retirement.

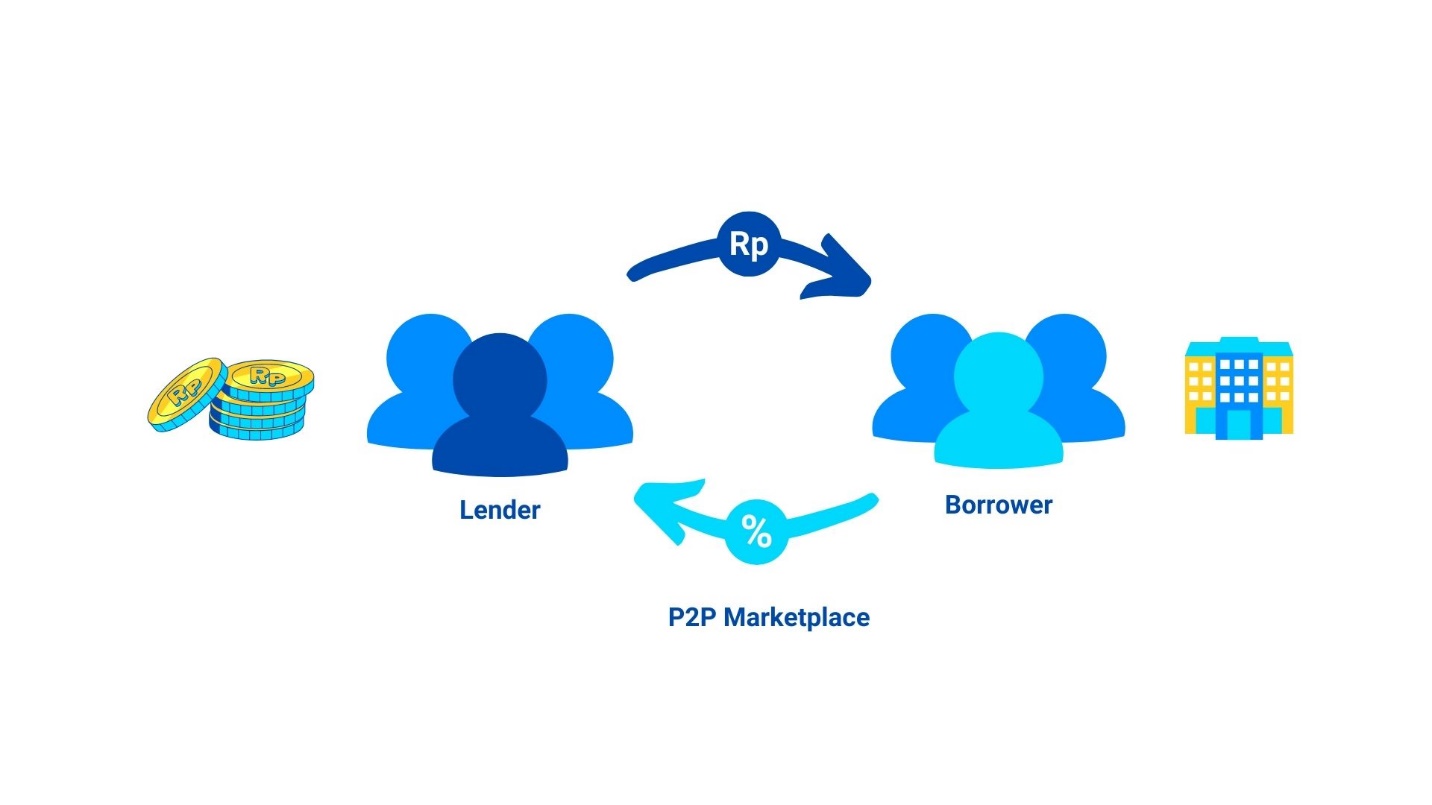

Peer-to-Peer Lending

The second way of creating passive income as retirement income is through peer-to-peer lending. Through these platforms, you can give Money to people or minor business persons, with the capital you invest attracting interest rates. It may have higher yields than regular savings accounts. On the other hand, it is essential to consider the risk factors attached to it. Because gains from others can offset losses in one loan, a loan portfolio is a promising investment avenue for retirees hoping to earn a steady income.

Invest in REITs (Real Estate Investment Trusts)

If the management of rental properties is not attractive, then REITs provide a more accessible real estate investment method. REITs are those entities that invest their funds in earning income by acquiring and managing properties or otherwise providing real estate–related financing for income-producing assets and must, by law, distribute most of their earnings to their shareholders. Instead of directly purchasing real estate to earn an income from rent, you can do so with REITs without actual property. This option is diversification within the real estate market and a convenient method for developing income while in retirement.

License Your Work or Intellectual Property

If you have creative properties like patents, trademarks, or writings, you can assign their usage to others for consideration of Money paid to you. It means that whenever somebody wants to use your invention, art, book, etc., all you'd have to do is sit back and watch the profits pour in; that is what is termed licensing. It is one of those strategies that can be used to tap into previous investments and start earning passive income once you are through with working.

Conclusion

Earning additional income after retirement is one of the best strategies for financial security in those years. In stocks through the dividend portfolio, in real estate or houses for rent, or even in digital products that provide recurring income, retirement is a good thing as one can have a passive income stream without working very hard. Thus, you need to ensure that you get more than one stream of income to cater to your needs, and the Availability of such opportunities, such as peer-to-peer lending or REIT, helps to bring such assurance. The strategies above shall enable you to have a comfortable and stress-free life as you retire by freeing your time to do what is most important.

(Writer:Hoock)