How to Improve Financial Stability After a Job Loss

One of the most challenging scenarios in anyone's life is to lose a job, but it is also one of the best times to rebuild again financially. It is, however, possible to take another attitude where one regains mastery over the finances and sets a new, more stable course. The following are essential steps toward enhancing financial stability when unemployment strikes:

Reassess Your Budget

Nevertheless, after becoming jobless, the first thing that should be done to enhance financial stability is to make a new budget. Check out your current budget and analyze which expenditure can be reduced. First, many expenses that are not urgent should be eliminated, and costs should be prioritized and categorized, like rent, gas, electricity, and food, while avoiding going to restaurants or cinemas. If one learns how to cut down on expenditures, such a person is in an excellent position to control his available income rather than exhaust all their savings.

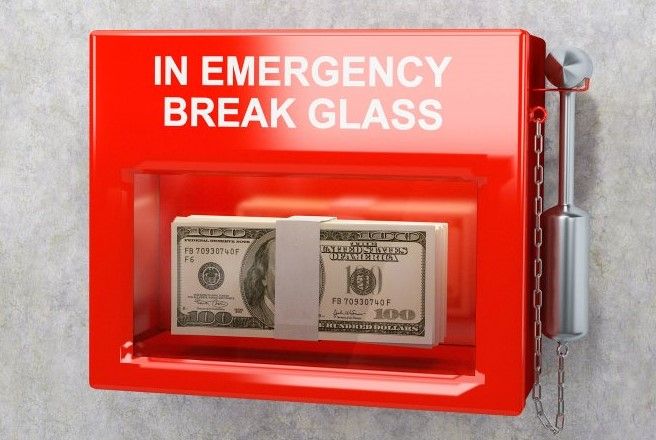

Build an Emergency Fund

If you have not read this, it is high time you established an emergency fund. An emergency fund is an insurance policy enabling you to spend cash when faced with an unplanned event without recourse to credit or borrowing. Regardless of your employment status, creating small piles for each paycheck, whether self-employed or receiving unemployment checks, is essential. Establishing this fund will act as an insurer as you face prospective vagueness.

Look for Temporary or Freelance Work

When searching for a full-time job, one should look for temporary or freelance work. Temporary or freelance work or a second job can be a way of making a guaranteed income or making some additional cash. Moreover, these jobs provide more flexibility to afford extra time to look for better-paying jobs or build a more secure livelihood. Temporary work also assists in increasing the number of known areas of specialization and contact with potential employers, having a higher chance at a permanent job.

Explore Financial Assistance Programs

If there is a problem with Money, remember to turn to government and community support services. There are various government aids such as unemployment compensation, housing subsidies, and food stamp programs that the government seeks to help people change their economic status in case of losing jobs. See what is out there and what you can get, then fill in the necessary paperwork to get it if you meet the requirements. Using these resources can help avoid high-stress levels resulting from financial demands and help to look for more suitable full-time jobs.

Pay Off Debts Strategically

Debt becomes a real problem after job loss, but high-interest debts should continue to be paid off. They are contacted to discuss how payment can be made or even interest rates can be lowered. There are always those creditors who may allow you to be put on a hardship program or get a deferment when you are stuck on how you will manage to make the payments. Decreasing your debt allows you to spend more of your income and reach financial health.

Invest in Skill Development

A job is one of the most significant foundations for childhood dreams; however, one can enhance monetary security after getting fired by embracing the following: Investing in skill enhancement. This period should be used to enroll for and engage in online classes and seminars or acquire certification that makes the candidate more marketable. Enhancing your skills will not only help you get a new job but might help you get a better-paying job. This considers the booming industries and how best you can position your skills regarding market trends.

Conclusion

It is, therefore, essential to draw up a good plan of how one will come out of a financially insecure state after losing a job. Depending on the budget, creating an emergency fund, and looking for temporary work or financial help, a person can retake control of the situation. Also, more debt is paid off, and training in new skills will prepare for long-term success at a steadier pace. Though the journey may be long and complicated, these steps will help you toward more stability and less worry.

(Writer:Lily)